Credit Cards are still one of the best ways to make payments as individuals. Mobile payment apps and solutions are gaining popularity. For example, mobile wallets, payment apps, and QR codes. Most of the current mobile payment solutions mimic regular card readers. They use near-field communication (NFC) to send digital payments to card readers.

As per McKinsey’s 2022 Digital Payments Consumer Survey, 90% of Americans use some form of digital payment. They prefer apps like a wallet or p2p payment app. More than 62% of correspondences use many payment wallets or apps. The top form of payment wallet includes the following order issued by the bank, phone manufacturer, and/or a tech company.

Innovation and disruption are happening fast in the payments and fintech industry. Real-time payments are commonplace in many geographies including China and India. Now, these payment methods are also gaining ground in the US. Apple Pay, Google Pay, and QR codes which are Tap or scan-to-pay solutions are growing year after year.

Here we will explore some of the popular payment apps. These are alternatives to old-fashioned credit cards.

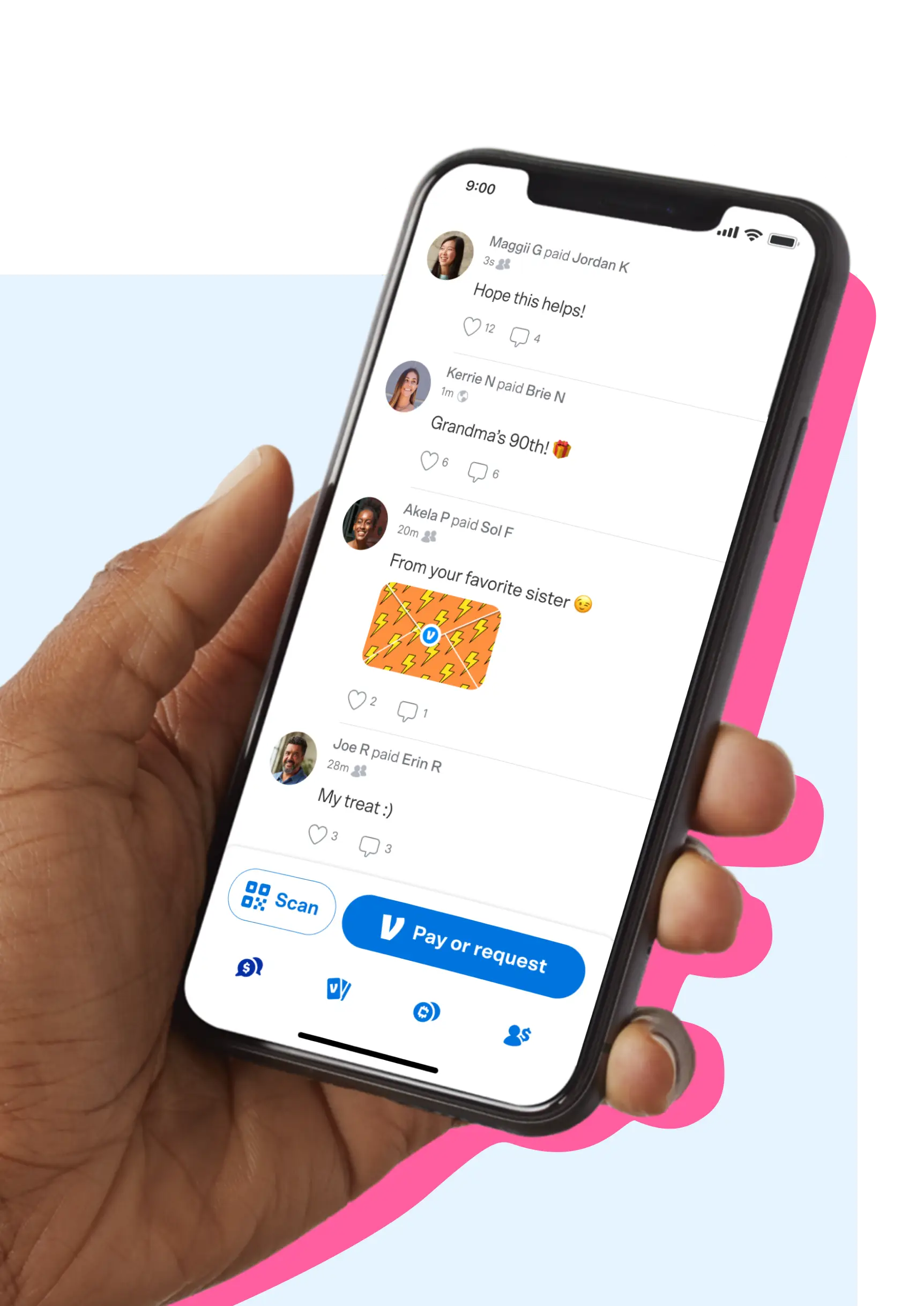

1. Venmo payment apps

The first app we would review is Venmo. It is a mobile payment app that allows users to make and receive payments. It is currently a part of PayPal Inc which acquired it in 2013 for $800 million. Venmo is available to download from the App Store or Google Play Store. The app can be set up in minutes to send and receive payments. It can be linked to users’ bank accounts or credit cards. Venmo-participating stores can receive payments directly from the app. It can also transfer money to other Venmo users.

It offers convenience and ease of use. Users can make and receive payments using their smartphones without carrying cash.

Venmo offers better security through encryption. The app has various security measures in place to protect users’ personal and financial information. It offers social features, such as the ability to add notes or emojis to transactions. It also has the option to share transactions on users’ social media feeds. This can make payments more fun and engaging.

It does not charge any fees for transactions. Members can use Credit Cards, Debit Cards, Bank Accounts, or Venmo Wallet. They charge a fee of 3% if payments are through a third-party Credit Card.

Venmo is available only in the USA. It requires both the sender and recipient to be in the USA. As Venmo is a mobile wallet and payment app, it is more suited and designed for small payments. As of now, there is a total limit of $60,000 per week. So it is not suited for large financial or business transactions.

2. PayPal

PayPal is one of the popular payment services. Investors Peter Thiel and Max Levchin founded PayPal in 1998. It is an online payment platform that allows users to make and receive payments. It has become one of the most popular payment platforms over the years across the world. Before the mobile wallets and Fintech waves of Web 2.0, PayPal was one of the popular payment platforms.

One of the main ways that PayPal has changed the industry is by making online payments more convenient and accessible. Before PayPal, online payments were often complex. Earlier users have to enter their credit card information on every website. Adding card details on many websites is risky. Users fear losing their financial information through bad actors. PayPal offers users anonymity with payments using their email addresses and password. Users do not have to worry about sharing their credit card information.

PayPal for Business payment apps

PayPal is more oriented toward business transactions, or payments for goods and services. It has changed the payment industry by offering extra services. It offers payment processing for merchants, credit and debit cards, and a p2p money transfer service. These services have expanded the reach and functionality of PayPal. It is one of the most comprehensive payment platforms.

PayPal is available in more than 200 markets worldwide. There are 400+ million Active consumer and merchant accounts in PayPal worldwide. It processes more than 5.5 billion transactions per year. The total payment volume processed by PayPal exceeds $340 billion.

Finally, PayPal has been in business for more than 20 years. It has acquired other Fintech companies. Zettle, Hyperwallet, Venmo, Simility, Swift Financials, and Xoom are part of PayPal. These acquisitions have helped PayPal to increase its in-store payment capabilities. They also have access to international geographies, security services, and other capabilities.

3. Apple Pay

Apple Pay is a mobile payment and digital wallet service offered by Apple Inc. It allows users to make and receive payments using their iPhones, iPads, or Apple Watches. It is linked to users’ credit cards or bank accounts. Participating stores can receive payments through Apple Pay. It makes the use of Apple Pay easier for the card members as well as the merchant.

Apple Pay is not a separate card or a wallet that stores any money. Customers can add their existing Debit or Credit Card to Apple Pay. They can then use the NFC function of their phone and use the virtual clone of their card.

As Apple Pay uses encryption it offers security. The service uses various security measures to protect users’ personal and financial information. Apple Pay is highly secured as the card information of the user is not stored in the device or servers.

As per the financial research firm Bernstein, Apple Pay is leaping ahead 4 years of its release. It now accounts for 5% of all global credit card payment volume. This is due to the strong penetration of Apple iPhones in the new age of users.

4. Google Pay

Google Pay is a digital wallet and payment platform from Alphabet, Inc. It enables customers to pay with Android devices in-store and on supported websites, and mobile apps. Google services, like the Google Play Store, only use Google Pay.

It uses encryption to protect users’ payment information. All the information travels securely between the devices and the Google Pay servers. It uses an extremely sophisticated layer of security. This is called tokenization and cryptogram. These Security features help keep the customer’s information safe. This means that even if someone were to intercept the transmission, they would not be able to read or access the payment information.

Google Pay also uses authentication to verify users’ identities. It ensures that only authorized users are able to access their payment information. This can include methods such as password authentication, fingerprint authentication, or facial recognition.

5. Samsung Pay

Samsung Pay is a mobile payment and digital wallet service by Samsung Electronics. It allows users to make and receive payments using their Samsung smartphones or smartwatches. Samsung Pay is linked to A user’s credit cards or bank accounts. It can be used to make payments at participating stores or within participating apps.

It uses advanced technologies such as Near Field Communication (NFC). Samsung Pay also uses Magnetic Secure Transmission (MST). This means that users can tap their phone on a payment terminal. They can also swipe their phone over a card reader to make a payment.

Finally, it offers security features, such as encryption and fingerprint authentication. It protects users’ personal and financial information. Samsung Pay also offers rewards and benefits. There are special offers and discounts for users who make payments with Samsung Pay.

6. Zelle

Zelle, founded in 2017 is another digital payment platform in the USA. It has become one of the most popular payment platforms in the United States. It is secure and easy to use. Because it is integrated with users’ existing bank accounts. To use the application, customers need to link their bank accounts to the Zelle app. They can then make and receive payments from their bank accounts.

Users do not need to enter their credit card or bank account information on the Zelle app. This further reduces the risk of fraud and makes the payment process faster and more convenient.

It uses encryption to protect users’ payment information. It also uses authentication to verify users’ identities. It ensures that only authorized users are able to access their payment information.

Finally, Zelle allows users to send money to other users using their email addresses or phone number. It also offers a peer-to-peer money transfer service called Zelle in the Bank. This service allows users to send money to other users who are not registered with Zelle.

Best Payment Apps

Finally, there is no one specific app that is the best among the ones we have seen above. All these apps help users make payments without carrying cash or a credit card.