Credit cards are an essential part of many people’s financial lives. They are also an important financial instrument. They offer convenience, flexibility, and rewards. But what exactly are credit cards and how do they work? In this post, we’ll explore the basics of credit cards. We will also explain how they can help you manage your money and build your credit score.

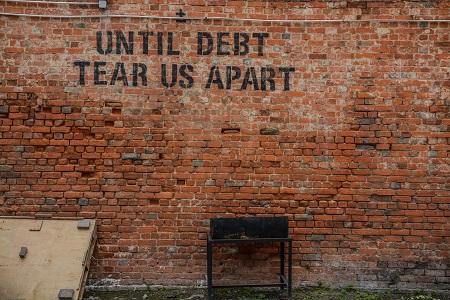

With all good things, there are some bad ones as well. The same is the case with credit cards. Indiscriminate high usage of credit cards and carrying balances can affect credit scores. Credit cards carry one of the highest interest rates on loans. These may be recipe for disaster for users as this may add to their debts.

To read about more basics of credit cards, please do read below:

- Best practices to use a credit card

- Credit card hacks to score best rewards

- Smart ways to improve credit score

- Improve safety and security of your credit cards

- Manage credit card debt management

What is a credit card?

First, let’s define what a credit card is. A credit card is a debt-based financial product. A credit card offers revolving credit limits to the issuer. The borrower or the credit card member can use the credit limit to make payments. They can use credit cards for shopping, dining at restaurants, and buying things online or at-store. The credit card company will send the member a bill for their outstanding balance.

Cardmembers will have to pay a minimum balance amount. If the member pays the bill in full in advance, their credit limit is restored and they have to pay no fee or interest. If the card member does not pay the balance, they will have to pay an APR (Annual Percentage Rate) and other late payment charges.

A credit card lets a credit card member borrow money and pay it back later. This means you can use a credit card to make purchases even if you don’t have the money in your bank account at the time. The credit card you use will determine how much you can borrow and the interest rate you’ll pay. Credit card companies are businesses that issue cards with specific terms and conditions.

When a card member uses a credit card, they’re taking out a short-term loan from the bank. The loan is from the issuer of the credit card issuing bank. As a customer of the credit card, you have a fixed period usually 25 days to pay the balance in full. A Card member has to pay late payment fees if they do not make the payment in time. The bank will charge APR on the amount as well. The interest rate on a credit card depends on the type of card and the creditworthiness of the card member.

Who are the different parties in a credit card?

Credit cards are a loan from the issuing banks to the card members. Unlike a personal or consumer loan, the credit card offers the flexibility of use. There are many parties in play with a credit card.

- Firstly, the borrower or the card member who applies for the Credit Card. The card members apply for the credit card and sign the card member agreement. A Credit card is a form of loan from the card issuer bank to the card member. They will check for the credit score of the card members before issuing the credit card.

- Next, issuing Bank that issues credit cards. They govern the payment terms, and applicable interest rates, and provide credit risks.

- Credit cards come printed with the names of other financial institutions. These include American Express, Visa, Mastercard, or Discover. These are the payment networks. These payment networks help clear payments while card members use their cards worldwide.

- Further, there are also co-branded credit cards by airlines, hotels, retailers, and other issuers. These co-branded cards provide bonus rewards to card members. These bonus rewards are applicable only to the issuing brand.

Key advantages of using Credit Card

Flexibility

Compared to debit cards, credit cards also offer great flexibility. A member is always limited with the balance in the checking account for spending. The spending power is equal to the money in hand. On the other hand, with a credit card, a card member can spend money on the basis of their credit limit.

Credit cards have a credit limit and card members can spend up to that limit in a given billing cycle. Further, they can use their credit cards to make emergency purchases. They can indulge to pay for things they can’t afford at the moment. They may not have that money available to them right now. Members can spend the money on credit cards and pay it on a fixed date as per the terms and conditions of the credit card.

For payments credit cards also offer flexibility. Card members can pay off the balance in full each month. They can also pay the amount in payment plans over months by paying the applicable APR or interest rate. Some credit cards also levy late fees and other charges on delayed payments. Always be conscious of spending money on a credit card. Do not get into the trap of spending too much.

Protection

Another, important key advantage of using a credit card over cash is an offer of a greater level of protection. When a customer buys something using a credit card, they are protected by the Fair Credit Billing Act. This law requires merchants to correct any errors on the credit card bill. It also gives the cardmember the right to dispute any charges they didn’t approve.

Rewards

Another important and lucrative advantage of using a credit card over cash is that it allows one to earn rewards. Credit cards have programs to offer rich rewards. Reward programs allow card members to earn points, miles, or cash back on their purchases. This means that every time a member uses their credit card, they’re also earning rewards.

Credit card issuers offer multitudes of rewards which may include:

- Airline miles with the airline and bank co-branded credit cards

- One-time bonus points or statement credits on new cards issuance

- Introductory low or even 0% APR on balance transfers or new purchases

- Bonus points on the anniversary of the cards for paying annual fees

- Free nights on co-branded hotel cards

- Faster points or miles on specific spend on dining out, travel, or streaming services

- Access to airport lounges on airline or travel credit cards

- Statement credits against fees of incidental charges on airports and other airport services

Credit Score

Besides the above advantages, using a credit card can also help build a card member’s credit score. A credit score or the most popular version FICO score is a three-digit number. This number reflects the creditworthiness of a customer.

A variety of factors affect the credit score of a card member. These include payment history, credit utilization ratio, credit mix, and credit history. It’s used by lenders to determine whether to approve them for credit and what interest rate to charge.

When a member uses a credit card, they’re building a credit history. This is an important factor in determining their credit score. Credit card companies report to the bureaus about the usage of cards, and late, or missed payments. As long as you make your payments on time and don’t exceed your credit limit, your credit score remains great. By using credit cards in a responsible manner, members can improve or build credit scores.

Always pay your credit bills on time and in full to the extent possible. I have personally had the misfortune of getting slapped with a late payment fee as well as credit bureau reporting for getting late for a single day. This is after I have a spotless history of on-time payments for more than 5 years.

Cash advance in a credit card

A cash advance is a facility to take advance cash from a credit card. A participating ATM can dispense this cash. This cash is a loan from credit card issuers and charges interest. There are fees for using this facility. The cash advance also carries higher applicable interest charges. This is a great facility in case of emergency or pinch. Do not take cash advances as a practice. It not only affects one’s financial goals, but a missed payment may also affect your credit score.

Shortcomings of Credit Card

There are several disadvantages or shortcomings of using a credit card. Firstly, it is a great financial product with ease of use. On the other hand, it is a disaster in hands of an overspender. For a shopaholic credit card is a path to Nirvana. It can fuel the endorphins of the shopper but may push them into the credit card debt trap.

Credit Score deterioration of the card members

High usage of credit cards can affect the credit score of members. If they consistently carry a high balance or make late payments, their credit scores may suffer. For a business loan or a mortgage, a good credit score is essential. A lot of young adults spoil their credit scores through the indiscriminate use of credit cards. Later when they actually need a loan they struggle.

Interest Rates and high fees

Credit card issuers charge high fees and interest rates on unpaid balances. They often come with fees, such as annual fees, balance transfer fees, and cash advance fees. These can pile on if a user is dependent on credit card debt. This can spiral out of control and leave unsustainable levels of debt.

Fraud

Additionally, credit cards are vulnerable to fraud and identity theft. They can cause financial and personal stress if you fell prey to the same. Always practice safe card usage. Read more for details on how to use your credit card safely.