Credit card hacks are legal ways to hack the most efficiency out of your credit cards. Pro credit card ninjas can make 3x-4x in benefits. Noobs use credit cards for payments and for easy credit access. Herein we will show you how to be a credit card ninja by learning the game’s tricks.

These are all 100% legit programs or rewards offered by credit card companies. We are not gaming the system or trying to hack any website. Our aim is to maximize the associated benefits of a credit card.

Finally, many credit card companies bundle direct cash benefits like cashback or reward points. Some cards may also bundle non-monetary benefits like free insurance, lounge access, etc.

So without further adieu let’s get into some of the hacks:

1. Credit Card hack to use only one specific Credit Card

Foremost, using one card helps members accumulate cashback and maximize rewards. Multi-cards distribute the spending and reduce the benefits. Members can get a better reward ratio by going for a reward or cashback card. These cards can help them get as much as $500 in a year. If they have a good credit score and have a habit of paying bills on time, it’s easy to get such cards.

Always set up automatic payments for your card bills and pay in full. This helps you avoid any late payment penalties. Card companies offer rewards and cashback only if the payments are paid in full and on time. To get the benefits you have to be prudent and pay on time.

2. Co-branded credit card hacks

These credit cards are some of the best ways to earn great rewards. Look at some of the popular websites or stores you frequent. All the big retailers and eCommerce stores offer co-branded cards with one or the other banks. Airlines and hotels also offer co-branded credit cards.

These credit cards offer rewards in the form of cashback on shopping from the website or store. They may also access the benefits of early shopping days. Some co-branded cards of eCommerce companies offer free shipping.

Always be very careful when opting for these cards. If you get too many cards, it may trigger an emotional response to more shopping. Be mindful of your shopping habits. Co-branded cards usually do not carry any membership or renewal fees. Some of the popular cards you can go for in this category are:

- Amazon Prime Rewards Visa Signature Card which offers 5% cashback on all purchases. This card offers even 10% cash back on some Amazon category buys. Outside Amazon, purchases fetch 1-3% cash back. This is a perfect card if Amazon is your go-to website.

- Target Red Credit Cards offer 5% cashback on shopping in the store and on the Target website. Members of this credit card also get free 2-day shipping and other hosts of awards.

- Costco Anywhere Visa Card from Citi is a good card for Costco members. This card offers 4% cash back on gas and 2% on all purchases from Costco. This card also offers cashback on purchases outside Costco. Costco Anywhere card requires you to have an active Costco membership.

Travel Rewards Credit Card hacks

If you travel a lot because of your business or job or personal travel. You should opt for Co-branded travel credit cards from the airlines. These credit cards help you with free flights or enhance benefits. Members get flight miles when they use these cards for their outside spending. These cards usually offer extra cash back on dining, car rentals, hotel stays, etc. Finally, these cards may reimburse the fees for TSA Precheck or Global Entry programs at airports.

Some popular examples of such cards are

- Delta Skymile Amex Card

- Southwest Rapid Rewards Visa Card

- AAdvantage Credit Cards from Mastercard

- United Credit Cards from Chase

It makes sense to choose one of the airlines as a preferred one and its co-branded card as the preferred card. Do not go overboard with too many credit cards here.

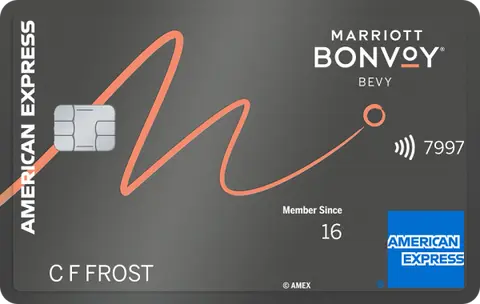

Card members can also opt for a co-branded credit card from a hotel chain. Select a popular big chain like Marriott or Hilton which would have hotels in many cities as well as internationally. Marriott offers Marriott Bonvoy Credit Cards from Chase and American Express. These cards offer free nights, accelerated points, elevated status, and benefits to the members.

These cards are beneficial for frequent travelers. Everyone loves to travel these days and the trends on Tiktok and Instagram help people select destinations. People can get further advantages by selecting a better travel card.

4. Apply for Multiple Credit Cards

Once you are comfortable with choosing one card and are financially responsible, apply for multiple credit cards. Multiple cards help you split your monthly spending into various categories. Members can use rewards or cashback cards for grocery shopping. Further, they can opt for travel co-branded cards for traveling or dining-related benefits.

Big card gurus go for 10-12 new cards every year. They may even hack the system to get welcome benefits on a credit card. If your spouse has a good credit score, you can opt for a second referral credit card in their name. You will get twice the welcome bonus and referral bonus as well. This is one of the great hacks to multiply the rewards.

One good example of such a card is the Chase Rewards Freedom card. This card offers 50,000 points when you spend at least $4,000 in the first three months of card issuance. Once you have reached the limit, refer your spouse or partner for a new card, and you can repeat the benefits.

Credit card companies keep elaborate data on their customers. So users can’t go on repeat and rinse the above technique several times. But even for one time, this is a good hack for reaping rewards. Do note that applying for certain credit cards may require a hard look at your credit score. This may also affect your credit score briefly.

Also, keep in mind not to get into the debt trap by spending too much on credit cards. Further, your credit history may go for a toss if you are not able to manage your cards.

5. Luxury Cards

There are high-end luxury cards offered by issuing banks or co-branded by luxury brands. These luxury credit cards offer exquisite rewards and offers. One obvious downside of such cards is that they usually come with hefty joining fees. They may also have annual renewal fees.

There is a delicate balance on these cards as the rewards are mouth-watering. For example, Golf Club Memberships, Free access to platinum lounges, and Premium membership status in hotels and airlines can be yours. But are you okay to shell out hundreds of $$ in annual membership fees? This is a question to ponder.

Credit score betterment

Credit cards can also help you improve your credit score. If you have a balance available on one of your credit cards, increase the credit limit of the card. This will help the member increase the credit ratio which will improve the credit score. Do remember this activity takes time and it may take months before your credit score moves.

Finally, the aim of the game is to maximize the rewards and not let the credit debt pile on. Credit card debt has one of the highest interest rates and penalties, so be conscious of using your cards. Don’t overspend to reach a rewarding milestone. The human brain is wired in such a way that we run towards a goal without thinking of consequences. Never fell into the debt trap. In conclusion, this game is about maximizing returns not selling your soul to become the slave of the card company.