Can you get a credit card with no credit checks? Yes, it’s actually possible with the neo-banks credit cards to rebuild credits.

Credit cards offer a credit line for a borrower. It is a debt product that helps a borrower use a credit facility from the issuing bank. Credit cards do a credit check for the borrower before issuing a credit card. If you have fair or bad credit, getting a hard credit check might further affect your credit. You can opt for credit cards with no credit checks.

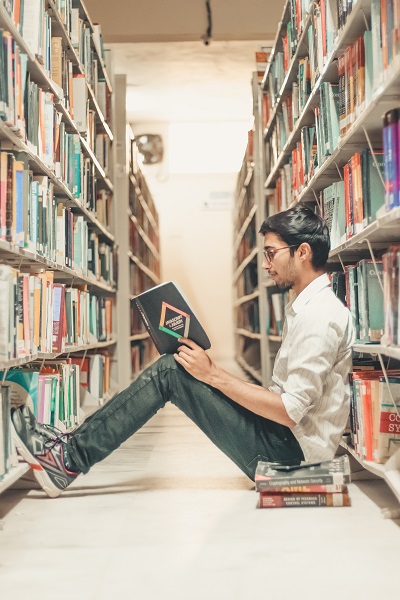

These credit cards do not put a hard inquiry on your credit score. Instead of relying on the traditional credit score such as FICO, they rely on the financial history of a borrower. They use proprietary algorithms to assess the creditworthiness of card members. They then issue a credit card with a limit for the user. Like any other credit card, paying on time can help build long-term financial health as well as traditional credit history.

Use cases for credit cards with no credit checks

These credit cards are best suited for people with no credit history or fair credit history. People with bad credit history may find it difficult to rebuild their credit. Instead of relying on touts or credit-building companies, they can either apply for secured credit cards. Another, option available is to use these credit cards which do not affect the credit score.

These credit cards are issued by neo-banks or new-age banks. Unlike traditional banks, which rely on FICO scores or credit scores from credit bureaus. These neo-banks build sophisticated algorithms to determine credit worthiness of members. They rely on your banking transactions, payment histories, and other financial histories to define your credit line.

Best examples of credit cards with no credit checks

Let’s now dive into some of the credit cards available in the market today, which require no credit checks.

TomoCredit Worldelite Mastercard

Fees: None

APR: None

Rewards: Tomo doesn’t offer any rewards to users for now.

In a nutshell: TomoCredit does not rely on the credit score to calculate the creditworthiness of a member. They ascertain the same based on their unique algorithm.

The spending limit on this credit card varies from $100 – $10,000. A user has to be pre-approved before they can get this credit card. If you are declined, you can’t reapply for Tomo credit card.

TomoCredit helps improve the credit score of card members. Additionally, they report to all three major US credit bureaus.

As this card has no requirement for a credit score, it is great to build the same. This is a great card for people with poor credit scores.

Tomo requires you to connect your banking account with their system. Once, they run their algorithm on your financial history to assign you a credit limit.

Members have to make a full payment of their dues at a pre-determined payment cycle. This payment cycle can be weekly, bi-weekly, or monthly. If you don’t pay your bills on time Tomo doesn’t charge you any interest but freezes your account.

Chime Credit Builder Secured Credit Card

Fees: None

APR: None

Rewards: Chime credit builder visa credit card doesn’t offer any rewards for the users.

In a nutshell: The Chime Credit builder secured credit card is a Visa credit card issued by Stride Bank. Further, this credit card has no annual fee or interest rate.

Additionally, the chime credit card has no minimum requirement for a security deposit. Though, the best feature of this credit card is that it doesn’t require a credit check to apply for it.

Although, for qualifying for this credit card you require a Chime credit builder account. Cardmembers can deposit their funds directly to their Chime credit builder account. Against this direct deposit, they can use their credit card to make everyday purchases.

Further, members can pay their dues by using the money in the credit builder account. Building good credit habits and on-time payments will help users build their credit scores over time. Chime credit builder could also be a good financial product for a beginner as well. Even non-USA citizens can apply for this credit card. This could also help them build their credit score in the USA.

OpenSky Secured Visa Credit Card

Fees: OpenSky Secured Visa credit card charges a low $35 annual fee to card members.

APR: None

Security Deposit: Low-security deposit starting from $200 and can go up to $3,000.

Rewards:

In a nutshell: OpenSky Secured Visa credit card is a secured credit card. This credit card starts as a secured credit card. But, a user can improve their credit score through good financial habits. Once, they improve their credit score they can upgrade to an unsecured card in 6 months. OpenSky reports to all 3 major credit bureaus in the USA.

Cardmembers can start with a low-security deposit of $200 and a maximum of up to $3,000. Once they deposit this security amount, their credit card is approved for usage.

Members can use the credit card to make normal everyday purchases. In order to, provide a boost to their credit scores, they should try and keep their credit utilization under 30%. Further, they can start paying their payments in full or at least minimum dues to help rebuild credit.